Get Clarity on SaaS Sales and Use Tax: Download Our Sales Tax Compliance Guide

Are you struggling to determine which states require you to collect and remit sales and use taxes on your SaaS product? It's a complex issue that can quickly become overwhelming, but don't worry – Scrubbed has you covered.

[ SNEAK PEAK ]

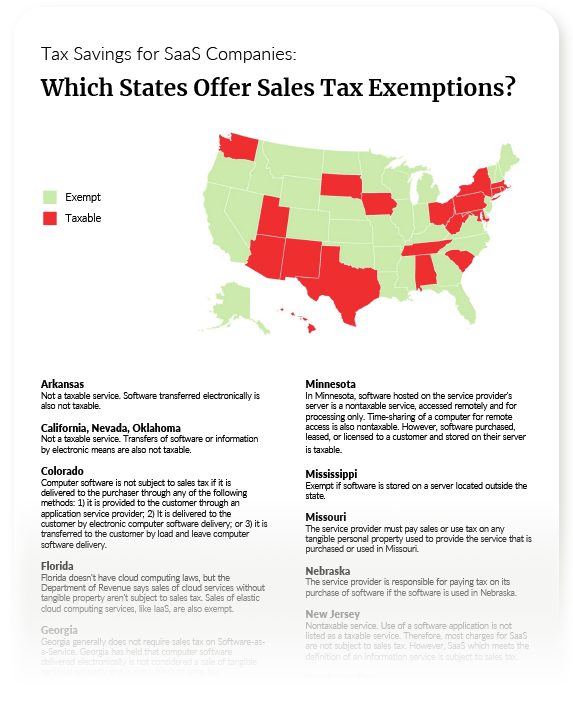

Our new SaaS Sales Tax Compliance Guide by State is your ultimate guide to understanding SaaS taxability. This comprehensive guide breaks down each state's tax rules, so you can quickly and easily determine whether your product is taxable or exempt in each state.

With our guide, you can:

- Avoid costly penalties and interest charges by ensuring you are properly collecting and remitting the right taxes in every state where your product is sold.

- Simplify the complex issue of SaaS taxability and get clear on the sales and use tax rules in each state.

- Save time and effort by having all the information you need in one convenient location.

We understand that determining the tax liability for your SaaS product can be a headache. That's why we've compiled this handy checklist to make the process as easy as possible for you.

Don't let SaaS taxability hold you back any longer. Visit our SaaS Page today and get the peace of mind that comes with knowing your business is compliant.

%20no%20margin.png?width=200&height=50&name=Scrubbed%20Logo%20(horizontal)%20no%20margin.png)